The smart Trick of Mortgage Brokerage That Nobody is Discussing

Wiki Article

The Ultimate Guide To Mortgage Broker Job Description

Table of ContentsGet This Report about Mortgage BrokerageThe 5-Minute Rule for Mortgage Broker Assistant Job DescriptionBroker Mortgage Rates Things To Know Before You BuyUnknown Facts About Mortgage Broker Assistant Job DescriptionAn Unbiased View of Broker Mortgage CalculatorOur Mortgage Broker Average Salary StatementsBroker Mortgage Fees Fundamentals ExplainedAbout Mortgage Broker Assistant

What Is a Home loan Broker? The home mortgage broker will certainly function with both celebrations to obtain the private authorized for the lending.A home loan broker usually works with many various lending institutions as well as can use a range of loan alternatives to the consumer they work with. The broker will accumulate details from the private as well as go to numerous lenders in order to find the ideal possible lending for their client.

Things about Broker Mortgage Fees

All-time Low Line: Do I Required A Mortgage Broker? Functioning with a mortgage broker can save the borrower time and also initiative during the application procedure, as well as possibly a lot of money over the life of the loan. In addition, some lenders work solely with home mortgage brokers, indicating that consumers would certainly have access to car loans that would or else not be offered to them.It's critical to examine all the charges, both those you might need to pay the broker, as well as any kind of charges the broker can aid you avoid, when evaluating the decision to work with a mortgage broker.

Mortgage Broker Fundamentals Explained

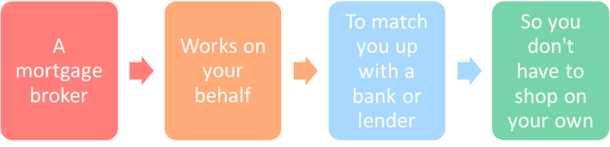

You've possibly listened to the term "home mortgage broker" from your real estate agent or pals who have actually gotten a home. What exactly is a home mortgage broker and what does one do that's different from, state, a funding officer at a financial institution? Geek, Budget Overview to COVID-19Get response to concerns concerning your home loan, travel, funds as well as preserving your satisfaction.1. What is a mortgage broker? A home loan broker serves as a middleman in between you as well as potential lenders. The broker's job is to contrast home mortgage loan providers on your part as well as find rates of interest that fit your demands - broker mortgage meaning. Home loan brokers have stables of lenders they work with, which can make your life easier.

The Ultimate Guide To Mortgage Broker Job Description

Exactly how does a home loan broker get paid? Mortgage brokers are most commonly paid by loan providers, sometimes by borrowers, but, by law, never ever both.The competition and home costs in your market will have a hand in dictating what mortgage brokers cost. Federal regulation restricts exactly how high settlement can go. 3. What makes home loan brokers different from lending policemans? Funding policemans are employees of one loan provider that are paid established incomes (plus bonus offers). Finance policemans can write just the kinds of financings their company chooses to offer.

The 4-Minute Rule for Broker Mortgage Calculator

Home mortgage click here to find out more brokers might have the ability to give debtors accessibility to a wide option of financing kinds. have a peek at this website 4. Is a mortgage broker right for me? You can conserve time by making use of a home mortgage broker; it can take hrs to make an application for preapproval with different lending institutions, after that there's the back-and-forth interaction associated with financing the car loan and guaranteeing the deal stays on track.When picking any lender whether with a broker or directly you'll want to pay attention to loan provider costs." Then, take the Financing Price quote you get from each lending institution, put them side by side and also contrast your interest rate as well as all of the fees as well as shutting costs.

Indicators on Mortgage Broker Association You Should Know

mortgage broker jobs 5. Just how do I pick a home mortgage broker? The very best way is to ask close friends and also family members for references, however make certain they have really used the broker as well as aren't just going down the name of a former college roomie or a far-off associate. Learn all you can concerning the broker's solutions, interaction design, level of knowledge and also strategy to customers.

Mortgage Broker Assistant Job Description Things To Know Before You Buy

Competitors and also house rates will certainly affect just how much mortgage brokers earn money. What's the distinction in between a home loan broker as well as a loan policeman? Home mortgage brokers will certainly work with lots of lenders to locate the very best funding for your scenario. Lending policemans benefit one lending institution. How do I discover a home mortgage broker? The ideal means to locate a home mortgage broker is via references from family members, friends as well as your genuine estate agent.

A Biased View of Mortgage Broker Job Description

Acquiring a brand-new residence is one of one of the most complex occasions in a person's life. Quality vary considerably in regards to design, amenities, college district as well as, of training course, the constantly vital "area, place, area." The mortgage application procedure is a complex element of the homebuying procedure, specifically for those without previous experience.

Can determine which concerns could create troubles with one lender versus one more. Why some purchasers stay clear of mortgage brokers Sometimes homebuyers really feel more comfortable going straight to a big bank to protect their funding. Because situation, purchasers must at the very least consult with a broker in order to recognize all of their alternatives relating to the kind of funding as well as the available rate.

Report this wiki page